MGI Worldwide international accounting network's Global IFRS Group publishes Overview of IFRIC 22

MGI Worldwide’s Global IFRS Group has prepared a paper that clarifies the accounting for transactions that include the receipt or payment of advance consideration in a foreign currency.

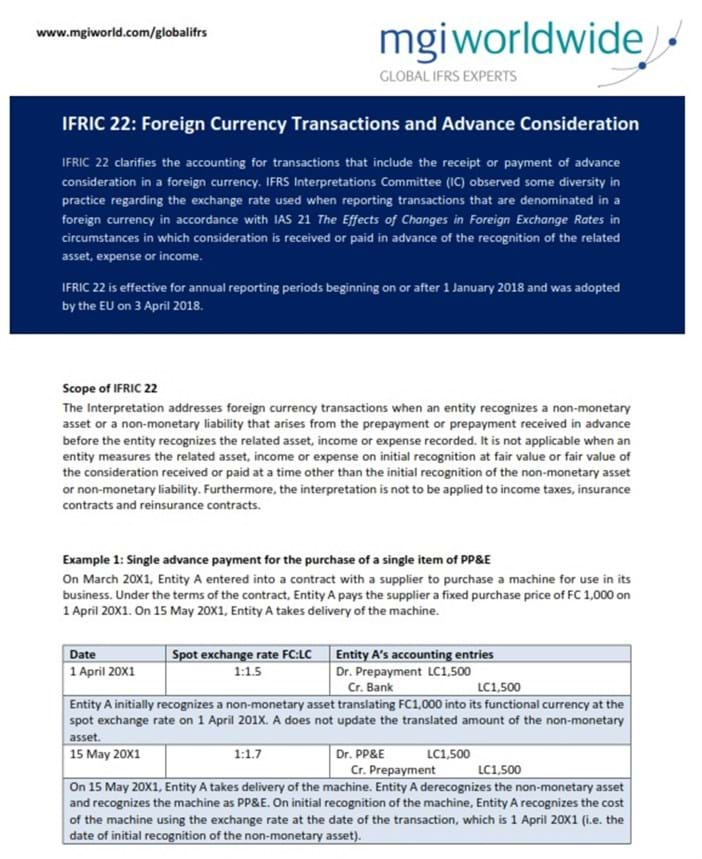

IFRS Interpretations Committee (IC) observed some diversity in practice regarding the exchange rate used when reporting transactions that are denominated in a foreign currency, in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates, in circumstances in which consideration is received or paid in advance of the recognition of the related asset, expense or income.

IFRC 22 is effective for annual reporting periods beginning on or after 1 January 2018, and was adopted by the EU on 3 April 2018.

Contact MGI Worldwide’s Global IFRS Experts

MGI Worldwide’s team of Global IFRS Experts deal with IFRS on a daily basis, share knowledge and best practices, and ensure the correct application of IFRS on a global consistent basis. For more information visit www.mgiworld.com/globalifrs

DOWNLOAD THE IFRIC 22 PAPER HERE

For more information please contact the MGI Worldwide Global IFRS Group: www.mgiworld.com/globalifrs

MGI Worldwide is a top 20 ranked global accounting network with some 5,000 independent auditors, accountants and tax experts in over 260 locations around the world.