LTA Tax s.r.o. creates useful tax card offering a detailed overview of the tax requirements in the Czech Republic

MGI Worldwide accountancy network member firm LTA Tax s.r.o. has created a 2019 tax card summarising all tax requirements and need-to-know figures for those living and working in the Czech Republic. The card is aimed at both promoting awareness of tax requirements and highlighting the areas in which individuals can make savings.

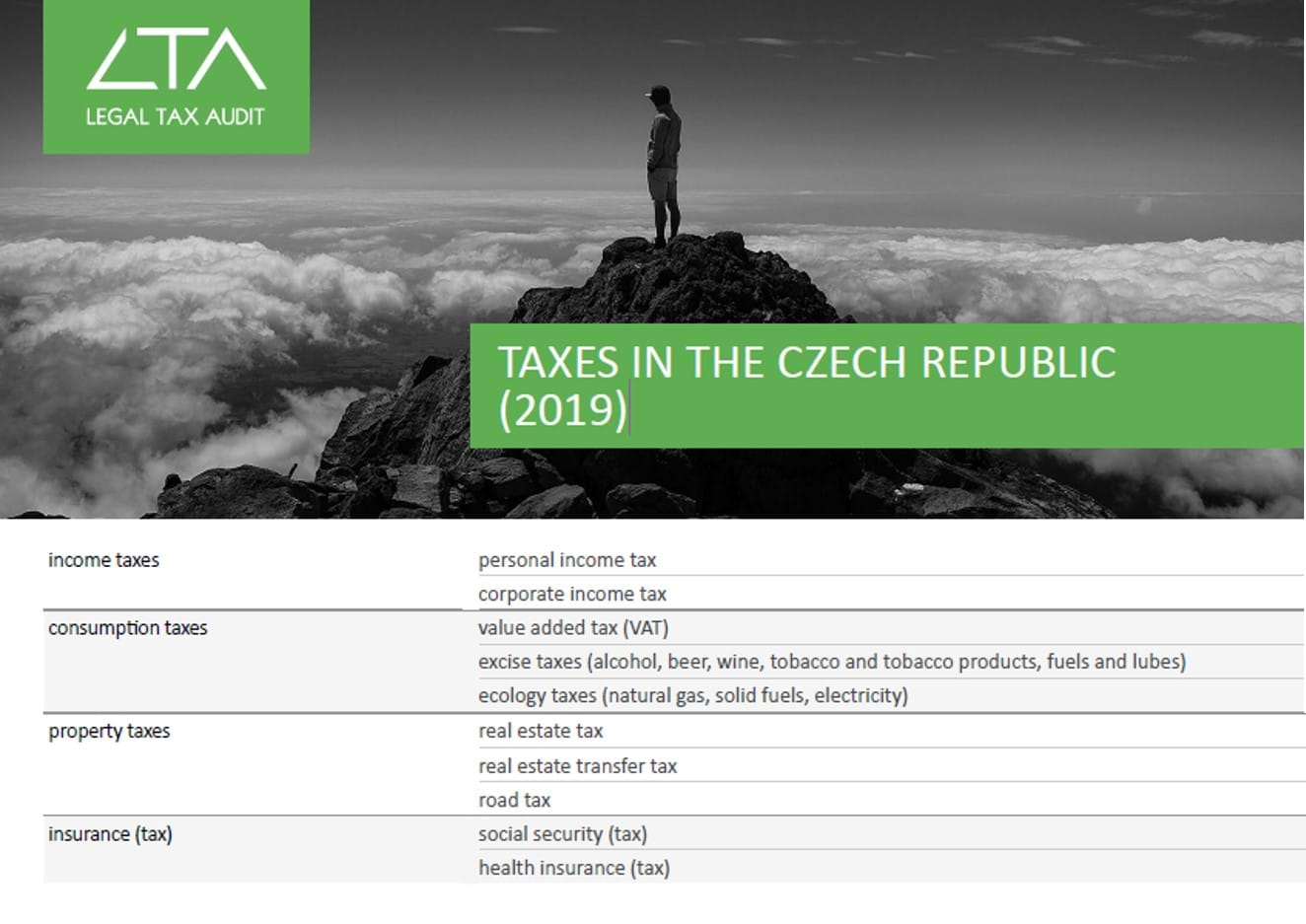

The handy card covers income, consumption, property and insurance taxes and breaks down each area into the rate brackets that people need to be aware of, along with the selected exemptions that could help save them money.

The Czech Republic has a wide network of double taxation trea

ties with 87 countries, and the card also lists those most frequently used, alongside their dividend and royalties’ percentages.

ties with 87 countries, and the card also lists those most frequently used, alongside their dividend and royalties’ percentages.

LTA Tax s.r.o. is a modern consultancy firm providing integrated legal tax, accounting and auditing services. The core principles of their business are professionalism, individual approach and transparency, and their latest tax card reflects their ambition to always keep their clients up-to-date with the most useful and beneficial information.

LTA Tax s.r.o. hope that their insights provide a useful guide to taxes in the Czech Republic.

You can download the tax card HERE.

For further information, please contact LTA Tax’s tax specialists, Hana Daenhardtová at [email protected] or Robert Koleňák at [email protected].

View the member profile page for LTA Tax s.r.o. or visit their website.

LTA Tax s.r.o. is a member of MGI Europe, part of MGI Worldwide, a top-20 ranked international audit, tax, accounting and consulting network with some 5,200 professionals in over 260 locations around the world.