EU corona legislation on the social security position of cross border workers

Last week, the Dutch Minister of Social Welfare and Employment announced in the Dutch parliament that, under pressure of employers, lobbyist groups and individual Euro parliament members, the EU has decided to continue the corona legislation put in place following the corona pandemic for cross border workers until 31 December 2022.

Under this legislation, it was made possible for EU cross border workers to work from their home during the pandemic without a compulsory change in their social security position.

From the announcement, it would appear to be derivable that this continuation will not only be applicable on present cross border working cases, but also future cases. The technical details are currently being finalized and are expected to be published shortly.

In light of this continued applicability until the end of the year, employers and employees will now have more time to assess possible changes in individual situations of continued home working and act accordingly.

It is important to note that the German authorities have confirmed that the bilateral agreement with the Netherlands in place on home working between the two countries will terminate on 30 June 2022.

It is important to note that the German authorities have confirmed that the bilateral agreement with the Netherlands in place on home working between the two countries will terminate on 30 June 2022.

This means that the arrangement under which home working would not lead to a shift in taxation from the “normal” work country to the home country for the employee during the pandemic will no longer be applicable from 1 July 2022.

Without a continuation of this individual agreement a cross border worker in the mentioned countries will in the scenario of “continued” home working become taxable in his/her home and work country for the income allocatable to his/her factual working day ratio between the two countries from 1 July 2022.

At the time of writing, it is not yet known if the bilateral tax agreement for home working between The Netherlands and Belgium will lapse or be extended.

Download the full article HERE

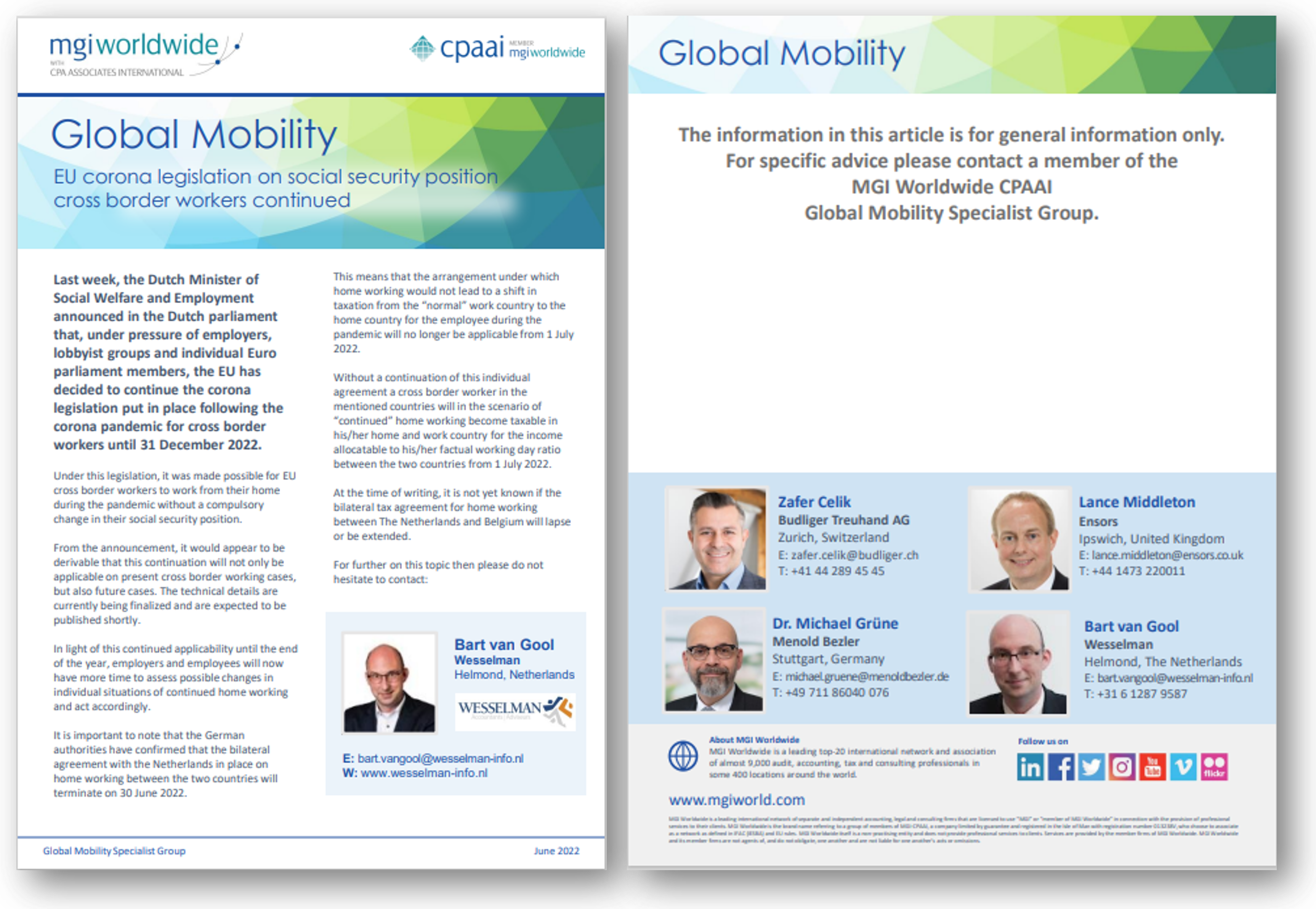

For further on this topic then please do not hesitate to contact Bart van Gool at [email protected].

MGI Worldwide with CPAAI, is a top 20 ranked global accounting network and association with almost 9,000 professionals, accountants and tax experts in some 400 locations in over 100 countries around the world.