Kamdar Desai & Patel Chartered Accountants, India-based MGI Worldwide accountancy network member firm, publishes white paper on 2019 India Union Budget Direct Tax Proposals

Kamdar Desai & Patel Chartered Accountants, India-based member firm of MGI Worldwide accounting network in the MGI Asia region, has published a whitepaper outlining the direct tax proposals of 2019 India Union Budget recently announced by the new Finance Minister of India, Ms. Nirmala.

The budget introduced incremental measures towards the development of various sectors of the Indian economy, especially infrastructure development, facilitating ease of banking and liberalizing the foreign policies to invite more foreign investors.

Direct tax proposals include:

1. Income Tax Rates:

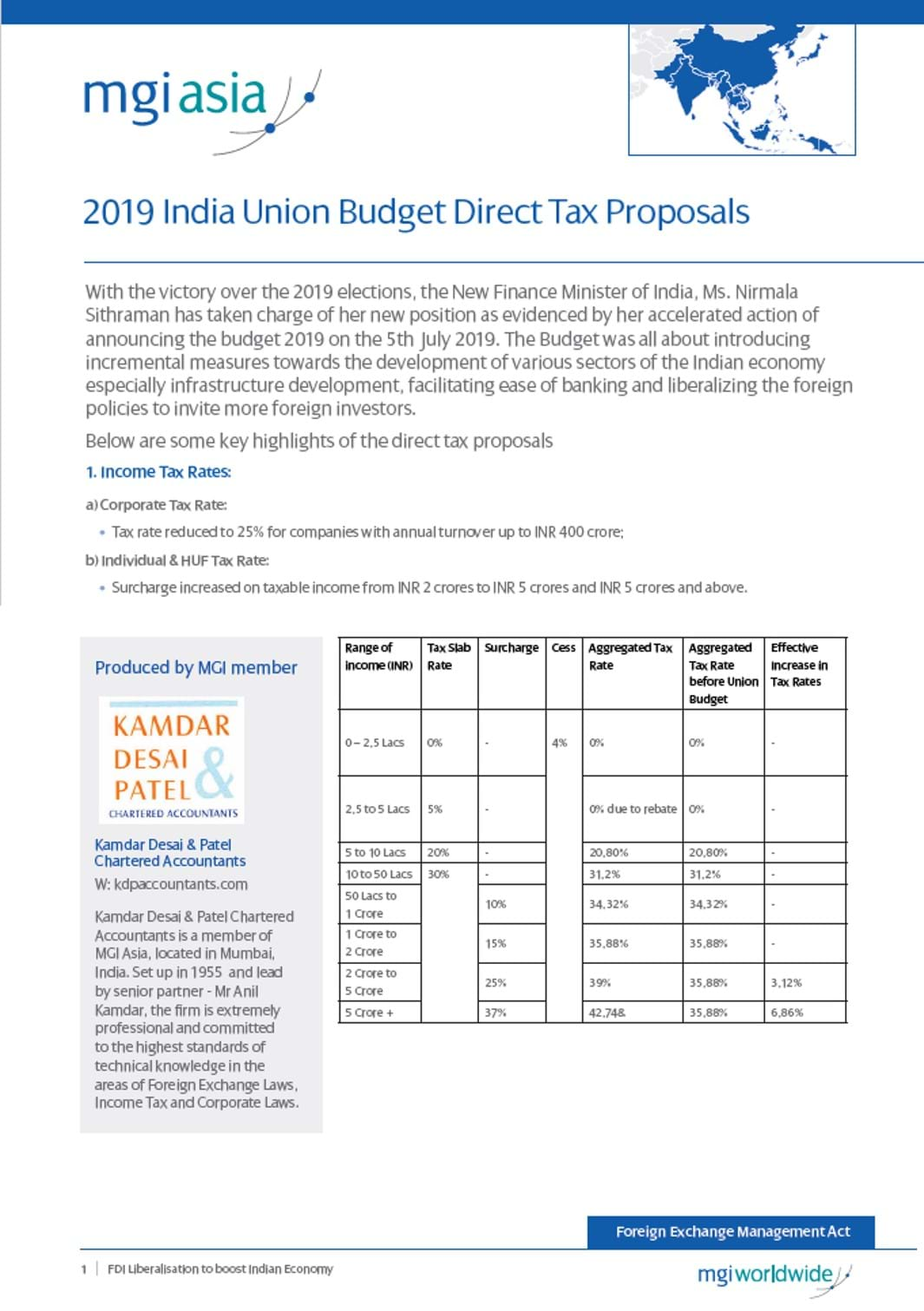

a) Corporate Tax Rate: Tax rate reduced to 25% for companies with annual turnover up to INR 400 crore;

b) Individual & HUF Tax Rate: Surcharge increased on taxable income from INR 2 crores to INR 5 crores and INR 5 crores and

above;

2. Income tax returns can now be filed using Aadhaar number in case a person does not have PAN.

3. Prefilled tax returns with details of several incomes and deductions to be made available. Information to be collected from banks, stock exchanges, mutual funds, etc.

4. Faceless e-assessment with no human interface to be launched in phase manner. E-notices to be issued without disclosure of assessing officer or their location information.

5. Additional deduction up to INR 1.5 Lacs for interest paid on loans borrowed up to 31st March, 2020 for purchase of house valued up to INR 45 lacs.

6. Individuals and HUFs will now have to deduct tax at source at 5% if aggregate sums paid or credited on account of contractual work or professional fees exceed INR 50 Lacs in a year. Earlier individuals or HUFs were not required to deduct tax at source on contractual work or professional services availed during the year unless such individuals or HUFs were subjected to tax audit.

7. Tax deducted at Source (TDS) at 2% will now be levied on cash payments in excess of INR 1 Crore in aggregate made during the year, by a banking company, co-operative bank or post office, to any person from an account maintained by the recipient in such organizations.

8. Additional income tax deduction of INR 1.5 lacs on interest paid on electric vehicle loans.

9. Funds raised by start-ups will not be subject to Income Tax scrutiny and there shall be mechanism for e-verification of identity of investor and source of funds.

10. Capital Gains exemption from sale of residential house for investment in start-ups extended till FY 2020-21.

Conclusion

The country has experienced positive vibes with, the Modi Government taking over for a second term. It is widely

expected to see growth and momentum in the economy. Moreover, there is an increased awareness amongst the

crowd about the tax measures and foreign policies further assisting in bringing down the unhealthy practices.

Kamdar Desai & Patel Chartered Accountants hope that this whitepaper is beneficial and provides a useful summary of the External Commercial Borrowings (ECB) framework.

For further details see the white paper HERE.

For further details please visit Kamdar Desai & Patel Chartered Accountants’ member profile page HERE or visit their website HERE.

Kamdar Desai & Patel Chartered Accountants is a member of MGI Asia, located in Mumbai, India. Set up in 1955 and lead by senior partner - Mr. Anil Kamdar, the firm is extremely professional and committed to the highest standards of technical knowledge in the areas of Foreign Exchange Laws, Income Tax and Corporate Laws.

MGI Worldwide is a top 20 ranked global accounting network with some 5,200 independent auditors, accountants and tax experts in over 260 locations around the world.